When you've got a properly set up banking account and get paid consistently, you’ll have the ideal odds of qualifying for high borrowing boundaries proper out of the gate.

The best paycheck progress apps aren’t really paycheck advance apps in the slightest degree. They’re thorough monetary technology apps that lover with FDIC-insured banking companies to offer checking accounts, price savings accounts, and possibly other account forms also.

But Venmo has additional users and somewhat a lot more characteristics, including a credit card choice. In case you ended up to vary companies, Venmo would probably be the only option.

There’s no price for this provider, however you can increase a “suggestion” of around $fourteen. Some even choose to “spend it ahead,” deliberately leaving A much bigger tip to address the fee for individuals who can’t afford to pay for it.

The Dave application’s ExtraCash™ attribute provides cash improvements of up to $500 per shell out period of time. With a qualifying checking account, you may get an progress as an everyday staff or freelancer due to the fact Dave considers your normal lender deposits and paying out rather then your get the job done several hours. You have to spend a minimal $1 month to month price to accessibility advancements, but strategies are optional.

Chime collects The cash Whenever your subsequent deposit reaches your account. There’s no charge, however , you can opt to suggestion.

There’s a fourteen-day free demo time period using a recurring $8 month to month subscription payment following that if you would like use Empower’s online monetary instruments (the payment isn't for cash advances).

These revenue lending apps LOVE to see standard recurring deposits from your task, here gig work, or federal government benefits like Social Safety. Many of these apps will even let you borrow should you’re unemployed!

The Earnin application connects on your employer’s payroll provider any time you join to mechanically decide That which you qualify for. There’s no credit history Test, so you don’t have to setup immediate deposit. And when you're employed once again tomorrow, You can utilize Earnin for getting cash then, too!

We downloaded and analyzed the twelve revenue borrowing apps on this list (additionally in excess of a dozen extra) to ensure they passed our strict “Is It Any Great?

Regardless that Upstart’s three-, five-, seven-yr financial loan conditions tend to be more restrictive than other lenders, it’s very likely to be a suitable tradeoff for applicants who may not be authorised in a more standard lending natural environment.

You'll be able to overdraft your account via debit card buys or ATM withdrawals without any overdraft service fees (limitations start at $20).

Some personal loan corporations also Allow you to prequalify for just a financial loan on-line. By prequalifying, you can Check out your prices without obligation or impact on your credit rating rating.

In case your employer associates with PayActiv, you can obtain approximately 50% within your paycheck beforehand, which might exceed other cash progress apps, determined by simply how much you earn .

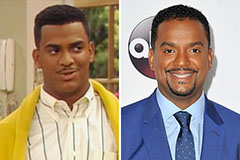

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now!